TermStreet Lenders

Close More Loans

TermStreet Lenders

Close More Loans

Lender Access

TermStreet is only as powerful as the strength of our lender relationships and we are always looking to enhance the network. If you believe you’d be a valuable contributor to the TermStreet Platform, please get in touch.

"Term Street's Technology Platform provides institutional-grade communication and collaboration tools enhancing your loan origination process. This means you close more loans with less effort. You spend less time on each deal and have a higher hit rate on the deals you choose to spend time on. We are built for borrowers, but lenders love us too"

~Matt Bertram, TermStreet Founder

Learn more about all of the benefits below:

Close More Deals

Build Direct Borrower Relationships

Faster Underwriting

How is that even possible? Click below for a demo of our first of its kind intelligence.

Efficient Communication

Never lose an email or file again or have to search through old emails looking for answers.

Repeatable Process

Easy Underwriting Handoff

Can you even imagine such a clean handoff?

Why Lenders

Love TermSt.

- Every Deal is prepared with the financials and rent roll spread in Excel. It is easy to either utilize our model for a quick analysis or cut and paste directly into your own model.

- Communication is simple and exponential as all lenders benefit from other lenders’ engagement on the platform.

- We give you direct relationships with our borrowers. That means you have better control over how your quote is communicated. No broker favoritism here.

- We work hard to vet each deal and we make sure the deals that you see actually fit your lending parameters. There is no spray and pray at TermStreet It is actually our goal to show each of our deals to the fewest lenders necessary to get the best available quote, not the most lenders.

Expectations For

Our Lenders

- Keep us up-to-date with your latest capital programs.

- Engage with deals. Pass quickly if it’s a pass. Dig in and ask good questions if you are interested. We measure lender engagement over time and we will let you know how you compare with other lenders.

- Provide quotes utilizing our Quote Manager. Quote competitively and quickly, but vet before you quote.

- Perform. The quickest way to get the boot from our platform is unwarranted retrades. If you value us, we will value you. We have zero patience for “sign it up and figure it out later”. This isn’t baseball, you don’t get three strikes.

Why Lenders

Love TermSt.

Expectations For

Our Lenders

- Every Deal is prepared with the financials and rent roll spread in Excel. It is easy to either utilize our model for a quick analysis or cut and paste directly into your own model.

- Communication is simple and exponential as all lenders benefit from other lenders’ engagement on the platform.

- We give you direct relationships with our borrowers. That means you have better control over how your quote is communicated. No broker favoritism here.

- We work hard to vet each deal and we make sure the deals that you see actually fit your lending parameters. There is no spray and pray at TermStreet It is actually our goal to show each of our deals to the fewest lenders necessary to get the best available quote, not the most lenders.

- Keep us up-to-date with your latest capital programs.

- Engage with deals. Pass quickly if it’s a pass. Dig in and ask good questions if you are interested. We measure lender engagement over time and we will let you know how you compare with other lenders.

- Provide quotes utilizing our Quote Manager. Quote competitively and quickly, but vet before you quote.

- Perform. The quickest way to get the boot from our platform is unwarranted retrades. If you value us, we will value you. We have zero patience for “sign it up and figure it out later”. This isn’t baseball, you don’t get three strikes.

Getting Started With TermStreet is Easy.

How Easy Is It?

All we need is your basic contact information and a summary of the types of deals you’d like to see and we will take care of the rest. At TermStreet, you don’t browse for deals… We send you deals that fit your profile. It is that easy. You do not even need to create an account until after you get your first deal from us.

Blog Posts

Read up on what we are thinking and talking about…

How To Pick a Fannie Mae or Freddie Mac Lender

Multifamily Finance is All About the Quid Pro Quo Quid pro quo is a Latin phrase that means “this for that.” And it describes the concept of getting something in return. When we use it

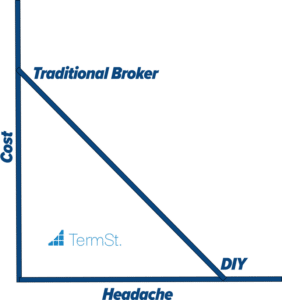

Empowered Advisory

Empowered Advisory makes TermStreet Different Empowered Advisory is TermStreet’s tech enabled advisory program. TermStreet is the only institutional quality lender engagement tool on the market today. With this platform our team is able to offer

© 2022 TERMSTREET. LLC. ALL RIGHTS RESERVED.