What is C-PACE?

C-PACE is a real estate tax assessment-based financing facility that can be utilized to fund the new develop of commercial real estate projects or complete renovations to existing projects. In most cases, C-PACE funding occurs concurrent with a new senior loan funding, but many states also allow for the retroactive funding of a C-PACE facility. TermStreet developed a proprietary solution to assist in the recapitalization of struggling CRE assets utilizing a retroactive C-PACE facility. You can learn more about that solution [here].

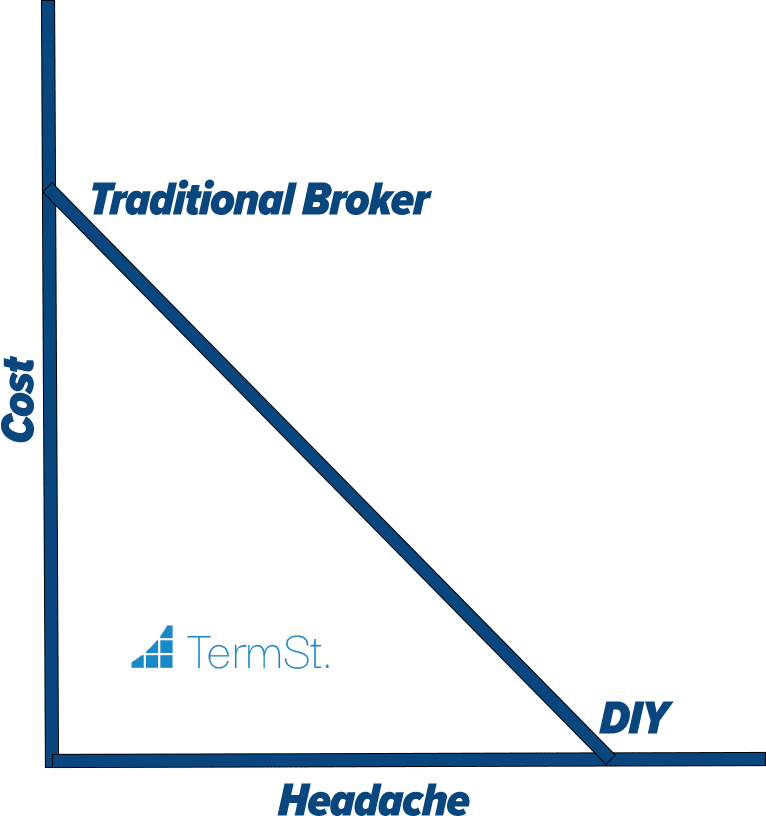

At TermStreet, we often describe C-PACE as an infusion of capital today in exchange for higher real estate taxes for the next 20-30 years. In most cases, the capital received today has a higher value than the net present value of the PACE repayment over time. The result is more valuable collateral for the senior lender. We share our valuation model [here].

A project qualifies for C-PACE facility dollars based upon 100% of the eligible energy efficient improvements, with the C-PACE assessment not to exceed 25-35% of the property value dependent upon the state. C-PACE loans typically amortize on a schedule based upon the average useful life of the eligible improvements, typically 20-30 years.

One question I’m frequently asked is whether the cost to implement the energy efficient improvements offsets the capital gained through the financing facility. In most states, the answer is NO. In most states with efficiency already built into the code, by building to code, a borrower will qualify for a significant C-PACE facility.

Is C-PACE a Loan? As a senior lender, am I subordinate to the entire C-PACE Facility? Why should I get comfortable with C-PACE?

C-PACE is a tax assessment. It behaves like real estate taxes for all intents and purposes and lenders should underwrite it as such. So yes, it likely brings down the value of your collateral and your loan amount should be adjusted accordingly. The value impairment is generally less than the initial C-PACE capital received off-setting the reduction in the senior loan amount. That said, the complete stack inclusive of PACE and the senior loan, will be superior for your client (at times just marginally superior and other times materially so).

It is critical to understand that C-PACE cannot be accelerated. As a lender, what that means is that only the unpaid portion of the C-PACE Assessment may be collected. Again, this risk can be underwritten. You may want to consider escrowing the C-PACE assessment payments to ensure they are paid.

Also critically important, C-PACE does not restrict a lender’s foreclosure or other remedy rights. Therefore, there are no long and complex intercreditor or co-lender agreements required. If there is a default on the senior lender’s debt, the senior lender can just foreclose without interference. This does not forgive the past due assessment payments, but the property can be transferred and sold subject to the current and future outstanding payments owed.

Additionally, C-PACE can be prepaid. A C-PACE facility typically comes with very flexible prepayment costs. In fact, loans are frequently open to be repaid at PAR after 3-4 years and we have seen examples of quotes with no prepayment cost at all during any part of the term.