Why you will borrower from the CMBS market over the next 2 years.

We are already in a liquidity crisis, and we do not fully realized it.

Earlier this week, a top 10 US Bank told me that they have enough capital for 10% of the volume they did last year. They are in full-on capital rationing mode. They can only help finance deals for their top clients, and even for those clients, they need to be extremely selective. The belt tightening is here in the banking world-and it is not just the big banks. We’ve had multiple deals dropped by regional and community banks around the country in the last two weeks as well.

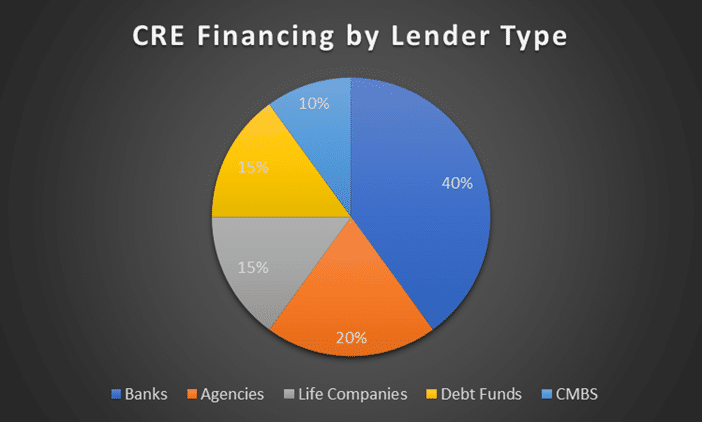

Historically, banks provide 40% or more of nationwide commercial real estate debt. But the banks are licking their wounds at the moment. The banks’ priority right now is dealing with overleveraged loans on their balance sheet that are past or approaching maturity.

My point is that your bank is probably not going to be there for you in the same way they have been in years past. If they are, you are in a unique position, and you should take advantage of that by getting the capital you need now. But if you are like most CRE owners around the country and you’re feeling stress from your relationship banks, it is good to understand the overall lending environment.

Very simply, here is approximately how the debt breaks down by lender type:

If we assume that going forward the new origination of CRE loans at banks is going to decline significantly, which piece of the pie will step up their origination and fill the void?

Life Companies – Life companies are generally healthy and lending right now, but their capital base is pretty static. They see CRE as a place to earn an excess yield right now while doing really safe deals. We love our life companies, and they might have a marginal increase in originations to help ease the pain of the bank liquidity crisis, but they don’t have the appetite to step up in a big way.

Debt Funds – There are a lot of highly liquid debt funds out there, and they may pick up some slack. In fact, we received a term sheet from a newly-opened debt fund this week that is very competitive. But a vast majority of the debt funds use leverage either from a CLO or a bank repo facility. This means that leverage is drying up fast (or has been dried up for a while). Over the next 10 years, debt funds will grow significantly, but over the next two years, they are not going to be the savior for our industry.

Agencies – The agencies are capped in their production at $150 billion. These caps might grow marginally to support the industry in a liquidity crunch. But keep in mind the agencies only finance housing-based properties, so they will not help across the rest of the CRE universe.

What Does that leave?

Oh yeah, I almost forgot CMBS… The capital source that everyone swears they never want to use (until the offer is too good to be true, that is).

I believe that over the next year or two, the CMBS lenders are going to offer a competitive product and significant liquidity to the CRE market. The CMBS market is mostly agnostic to cash-out, sponsor quality, property location, property type or any other metric another lender might offer as the reason for a no-quote or a weak quote.

Don’t ditch your bank if they are there for you. Get that Life Company quote if they are willing to provide it. But it is time to rethink CMBS for an industry that has mostly shunned the product for the last 15 years. Why? Because the CMBS market is capable of expanding to provide the capital the industry needs to continue operating. Back in 2007, the CMBS slice of the pie was over 50%.

If you are intrigued but a bit nervous about the CMBS market, check out an old blog post I wrote about getting good CMBS documents to prevent your own servicing horror story. (blog post here)

At TermStreet, we can give you direct access to all of the CMBS lenders (and all the other lenders too) through our technology platform. It only takes 20 minutes to create a package. We size the deal for you and make recommendations about the loan request before creating a competitive market to get you the best possible deal.