RECAP Loan Program, Powered by TermStreet

A White Paper Reflecting upon the recapitalization program created by TermStreet

The team at TermStreet has developed a proprietary capital solution for property owners impacted by Covid-19. In this white paper, the solution is explained and the impacts on both borrowers and lenders is discussed. Our RECAP Solution can be used to provide up to 25% of the original total capitalization of the real estate project, regardless of the valuation. We utilize a little know feature of the commercial PACE program to obtain retroactive PACE financing and then apply this new capital to establish a 12-18 month debt service reserve and reduce the principal balance under the existing loan. The result is a clear win-win as we will discuss here.

We view the RECAP Program as a simple, quick, and free workout program available to banks and borrowers in eligible areas. The program allows lenders to quickly workout a portion of the hardest hit loans in their portfolio so they can spend their time on new business initiatives.

While most lenders quote rates for PACE capital between 5.25-6.5%, TermStreet has proprietary solutions for larger deals to bring rates down as low as 4.5%. Reach out to me at matt@termst.com for more info.

~Matt Bertram Tweet

General Terms

A TermStreet powered RECAP Loan takes a similar security interest to a tax assessment. As such, the loan will take a senior collateral position relative to the existing lender. The RECAP loan cannot be accelerated and therefore we believe the senior lender should evaluate a RECAP Loan similar to how they would evaluate a ground lease that sits with similar priority to a senior loan. As such, in our analysis of the program, we include the loan payments under the RECAP Loan as an operating expense and run a net present value analysis to gauge the valuation impact of the RECAP Loan.

A TermStreet RECAP Loan carries the basic terms below, subject to underwriting and other requirements of the PACE Loan Program in the region the real estate is located within. Basic Loan Parameter are below:

Loan Amount:

Typically, 15-25% of the original capitalization of the project.

Loan to Value Requirement:

Typically None.

Term:

Up to 30 Years.

Amortization:

Typically 2 years IO, then 25 years amortization

Rate:

4.5 – 6.5%. Most PACE Lenders quote rates between 5.25-6%. TermSt. has proprietary solutions for larger deals to bring rates down as low as 4.5%.

Use of Capital:

The use of the capital is typically directed by the lender. Most lenders will utilize the capital to create a 12-18 month debt service reserve and then utilize the remainder to reduce the principal balance of their loan. This is up for negotiation between the borrower and lender.

Prepayment:

RECAP Loans typically carry traditional defeasance or yield maintenance; however, we can build in various step-down or other prepayment structures as desired by the borrower. Prepay can be extremely flexible.

Loan Assumption:

The loan runs with the land and is assumable by a future property owner.

Typical Results:

As mentioned above, we view a RECAP Loan as a true win-win for borrowers and lenders. A RECAP Loan is a pre-structured workout that has no out of pocket cost to the borrower nor lender. In fact, as you will see from our example, the LTV will be reduced as a result. We will run through an example scenario and provide our assumptions in the next section, but we expect typical results for the borrower and lender as follows:

- LTV is reduced by as much as 5% (ie. From 70% down to 65%)

- Lender’s overall loan exposure reduced by 15-20%.

- Debt Service payment is assured for the next 12-18 months.

- Borrower is able to focus operating capital on retaining key staff and property maintenance.

Impact Analysis – RECAP Example:

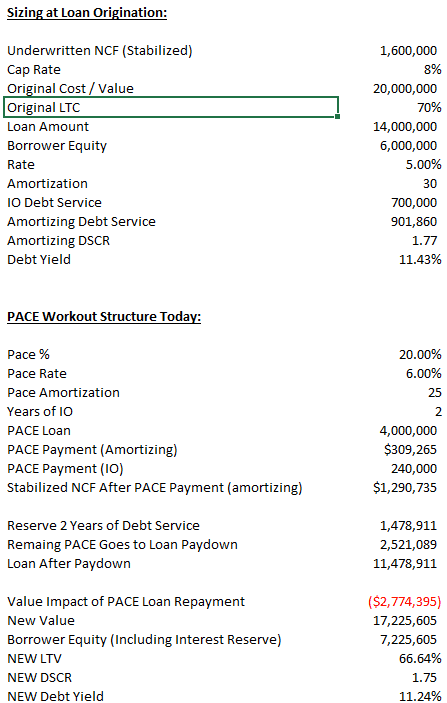

Below we show you an actual Impact Analysis for both a borrower and lender. You will see that all parties end up in a better place after the funding of a RECAP PACE Loan through TermStreet.

Results from the Impact Analysis:

- Lender LTV is reduced from 70% at origination to just over 66.5% after closing a RECAP Loan

Note: LTV is relative. We do not attempt to evaluate the value immediately prior to closing, we just assume the value at loan origination and adjust the value from there. Additionally, some might argue that we should include the RECAP Loan in the overall lender LTV, however, we believe given the loans position similar to a tax assessment and the fact that it cannot be accelerated, the best way to analyze the impact is to adjust the NOI for purposes of valuing the real estate.

- A reserve for Two Years of Debt Service is established

Note: This Assumes the existing loan is amortizing on a 30-year schedule. If the loan is in an interest-only period or if the lender agrees to convert the loan to interest-only in conjunction with the RECAP Loan, there will be additional capital available for other purposes.

- Borrower Equity is Increased

Note: Borrower equity is increased with the assumption that the debt service reserve is added to the equity. Given that this capital will be used to pay debt service, this is a reasonable assumption. Additionally, to the extent that the debt service reserve is not completely used, this capital ultimately accrues to the borrower.

RECAP Example

Provided below is one example of a RECAP Loan and the impact to both the borrower and lender. Cells highlighted in gray are adjustable assumptions in our model. Our model is available if you reach out so that you may modify assumptions and complete your own analysis.

Example: Hotel Transaction with a $20 million total capitalization

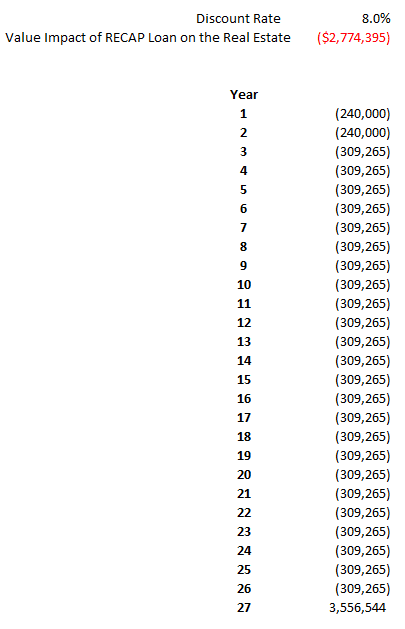

NPV Analysis:

This analysis shows the impact on property value from the resulting decrease in NOI: