Why Do I pose this Challenge Now?

I’ve spent the last several years building the TermSt. Martketplace (www.termst.com) and we are about to launch or 2nd generation product to the market. Having spent the last 20 years in the commercial real estate business, I’m not exactly the old guard, but I’ve certainly got more grey hair and experience than your typical CRE Fintech Entrepreneur. Some of the things I hear out of them make me cringe. Things like:

“By converting Real Estate Assets to Crypto, we can democratize real estate investment for the masses”

or

“Crowd Funding can provide the most efficient capital for real estate transactions”.

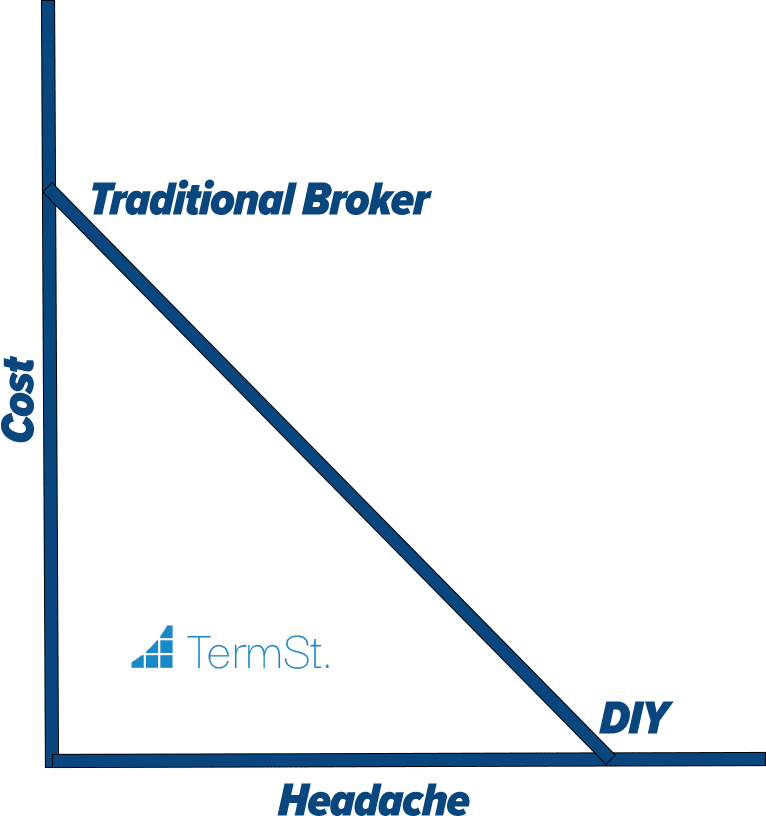

I’ve built TermSt. on a few core principles.

- We hold a fiduciary duty to our clients.

- The institutional market is the lowest cost and most efficient place to find capital for most real estate transactions.

- Do everything you can to put your client into the best product for their situation, which typically is the institutional market

As TermSt. grows we will hire people that understand and respect these core principles and bake them into the soul of our company. I challenge the entire CRE Fintech Space to follow me in these principles.

Here is Where I Start My Challenge:

Everyday I hear about a new company looking to “trade a building like a stock” or “use Crypto to create liquidity for real estate”, or “crowd fund from non-accredited investors”. The technology is here, or around the corner, to do all of these things.

Just because you can do something, doesn’t make it a good idea. What I’ve seen in the CRE business in the last 20 years is a constant attempt to syndicate dumb money. Essentially a real estate syndicator says, “Let’s go find some non-accredited investors and tell them some form of the following”:

“The wealthy have an unfair investing advantage because they have access to private investments like real estate”

AND

“We can offer you similar private investments”

Let’s start with a quick history lesson. Sometime in the 90’s, there was an invention called the Non-Traded REIT. Institutional Real Estate Companies espoused that for the first time, regular joe investors could access the private real estate deals that only the rich could access previously. If you’d like to read about how that turned out, check out this research paper written by Brian Henderson, Joshua Mallett, and Craig McCann called An Empirical Analysis of Non-Traded REITs. It is a long paper, but here is the punchline: “We estimate that non-traded REITs underperform the traded REITs by approximately 7.3% annually”.

What you will find is that fees were high and returns were low. CRE Professionals who started these firms became very wealthy, but they did a tremendous disservice to their investors. Frankly, some of them should probably be in jail. A side note, Blackstone and others now have Non-traded REITs that behave more responsibly with their investors capital so hopefully the future is brighter for this class of real estate investment.

Next came the evolution of crowd-funding. Basically you got the same pitch, “We can give you access to the types of investments that only the wealthy can currently access”. And, they came with high fees, bad risk/return deals, and overall low returns. Too many deals end up on a Crowd Funding Platform because they could not access more traditional money. Additionally, somehow the crowd funding platforms typically earn a piece of the deal in addition to their fee for placing the equity (odd). I’m not sure there is any research data on this yet, but rest assured, investors in this structure will get screwed over time. I will note that what I’m talking about here are third party crowd funders. There are many great examples of firms that are using technology to increase their investor base and market to new investors using the laws that enabled crowd funding, but they are doing it internally, supplementing their more typical capital raise process, and giving “crowd-funded” investors the same deal as their traditional investor base. If you are interested, a couple examples of firms crowd funding in a responsible way include Origin Investments (www.origininvestments.com) and Block Funds (www.blockfunds.com/). And I’m sure there are many others. If your firm would like to be added to this list, reach out to me at matt@termst.com and I will add you if you are responsibly supplementing your regular capital raise process with some version of crowd-funding.

Now we have startups trying to “tokenize” real estate deals. The pitch from these parties is the same old story, although they take it a step farther. So you get, “blah, blah, blah, invest like the wealthy, get access to private real estate deals… And the new kicker, because these deals trade on the blockchain and can be transacted instantly (like Bitcoin), you have liquidity.”

This is the biggest load of B.S. I have ever heard. Sure, putting an asset on the blockchain gives it a means for liquidity. But in order for something to actually be liquid, there must be buyers on the other side. For there to be buyers on the other side, there needs to be a flow of information so that potential buyers can complete due diligence. I’ve negotiated enough loan documents with real estate owners to know that they do not really have the ability to provide information on a timely basis and they certainly do not want to. Additionally, the cost of providing perfect real-time data on all of their transactions makes the entire process completely non-sensical. So sure, owning a small piece of the Ritz Carlton in Aspen sure sounds cool, but that does not make it a good investment. No doubt, there is probably liquidity, but the person providing liquidity is a shark and that liquidity is incredibly expensive (Expensive to create liquidity is actually the definition of illiquidity for anyone wondering).

As an industry it seems, Commercial Real Estate just cannot help itself and will not learn from the past. My challenge to everyone in the CRE FinTech Space is to be a good steward of capital and a responsible fiduciary. Make your fees easy to understand and lay out the risk of your transactions so everyone can understand. Just because it is possible, does not make it right. You know who you are.