When you pit C-PACE vs. a Ground Lease, C-PACE wins everytime

If you’ve read our other blog posts you have likely heard us describe C-PACE as an exchange of cash today for higher real estate taxes for the next 20-30 years. This is the absolute purest explanation for the true impact of C-PACE. That said, I constantly have conversations with borrowers and lenders where they want to compare C-PACE to something else that is common in the market and they already understand.

In that case, I really like the comparison of C-PACE to a ground lease.

Why? – Because most lenders are comfortable underwriting a loan in which there is a bi-furcation between the fee owner of the ground and the leasehold owner of the loan collateral.

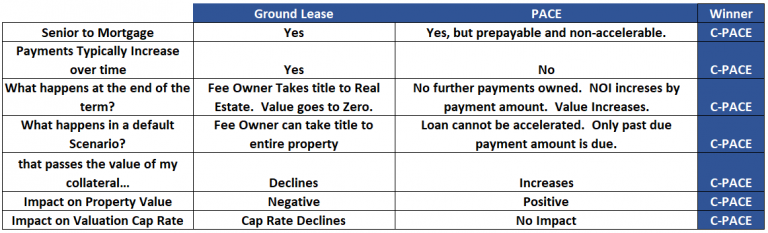

And the bigger reason I love this comparison is because there cannot be an argument as to which financing tool, C-PACE or a Ground lease, has the more material impact on a senior lender’s collateral. From a senior lender risk impact, C-PACE is far superior to any ground lease.

Why is C-PACE superior to a Ground lease?

The biggest reason that C-PACE is superior to a ground lease when analyzing senior lender impact is amortization. C-PACE amortizes off over its term and so the property value actually goes up after the last payment is made. The opposite is true for a ground lease – At the end of the term of a ground lease, the senior lender’s collateral value is zero. With a ground lease, everyday that passes, the senior lender’s collateral value declines as a result of the ground lease (1-day closer to losing the property to the fee owner). With C-PACE, each day that passes, the value of the collateral actually increases.

A further comparison of C-PACE vs. a Ground Lease is included in the chart below: