Empowered Advisory makes TermStreet Different

Empowered Advisory is TermStreet’s tech enabled advisory program. TermStreet is the only institutional quality lender engagement tool on the market today. With this platform our team is able to offer advisory that is completely different than you are used to.

Real estate owners have been stuck with only two options when it comes to their financing.

1) Hire an expensive mortgage broker to handle the full process for you. We call this Traditional Advisory and we do offer this as a service at times as well.

OR,

2) Handle all lender relationship building, outreach, communication, quote review, and negotiation by yourself which can be overwhelming even to an experienced capital markets team. We call this DIY.

Today, TermStreet offers Empowered Advisory which offers many of the same time and headache saving benefits of hiring a traditional broker without the large fee. Empowered Advisory gets your team powered up with TermStreet’s tools to improve communication flow, deal management, quote review, and negotiation. We allow capital markets teams to build strong and direct relationships with the lending community, whether engaging with your existing lending relationships or making new connections through our lender relationships.

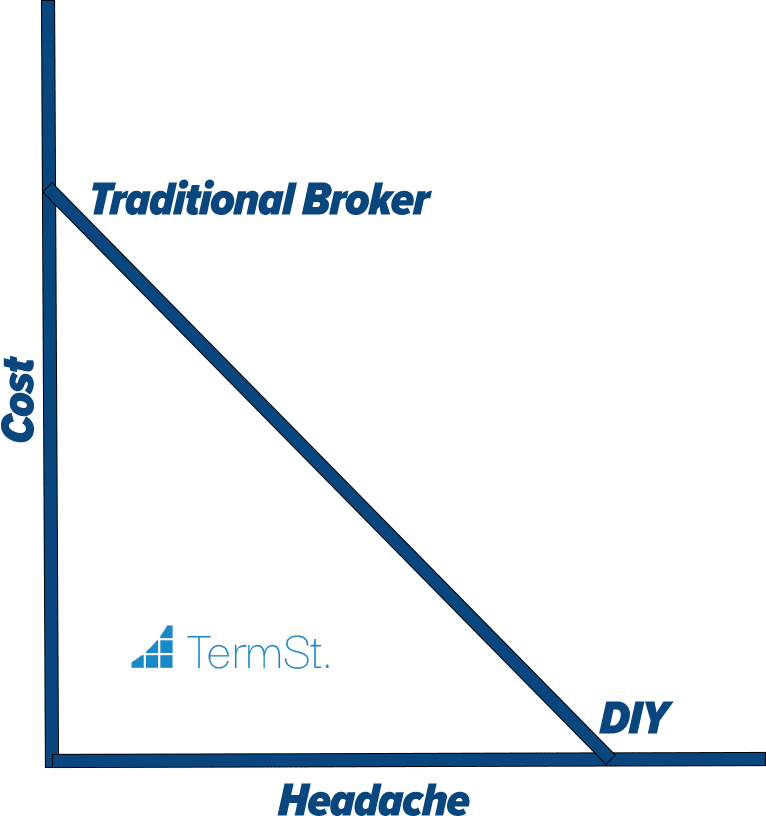

TermStreet's Headache/Cost Curve

I like to share what I call the Headache Cost Curve Chart to show how TermStreet cures some of your financing headaches while saving you significant money along the way. TermStreet might not be for everyone, but the value is Undeniable.

How can we save you both time and money on your next financing?

The quickest way to understand our tech tools is to check out this quick pain point demo where I show you how we solve three major pain points for your team.

Things to know about TermStreet:

1) We are not a broker and we do not get paid like a traditional broker. The core of our service is subscription based.

2) Our primary goal in the loan process is to connect you with the right lenders and help you build strong direct relationships and ultimately close a deal. After close, you own the relationship, not us.

3) We have a special program for Agency borrowers that you should check out because you will save a lot of money and guarantee that your interests are aligned with your advisor.

4) Our core clientele has an in-house capital markets team (or at least one person) and prefers to handle financing without a broker at least some of the time. If you do one deal with us, vs a traditional broker, it will pay for our service for the entire year.