PACE in the Capital Stack? How to Evaluate the Impact to Risk for the Senior Lender

The team at TermStreet has spent most of the last six months working with hospitality owners and lenders consulting on recapitalization options given the impact of the Pandemic on hotel owners and lenders. A C-PACE retroactive loan is the one option we have found that stands above the rest. We have put together an entire website to explain PACE and our proprietary retroactive facility. You can find the link to the site [here].

There is much confusion in the lending community about how a senior lender should evaluate the impact of a PACE loan on a Senior Lender’s Risk Profile. In this post, the Executive Team at TermStreet lays out their valuation case. This blog post assumes you understand the basic components of PACE. If you are new to PACE or need a refresher, check out our [What is PACE blog here].

There are various schools of thought on how a lender should evaluate the impact of PACE capital on their transaction risk. Many lenders jump straight to the conclusion that PACE Capital should be viewed as a loan that is senior to them in the capital stack. While it may be easy to jump to that conclusion, don’t jump so fast. A critical factor to understand is that the PACE Assessment cannot be accelerated. Therefore, the only sum that can ever be payable is the current amount due or past due on the PACE Assessment – Not the entire outstanding balance of the PACE Capital.

I’ve also heard that PACE should be viewed similar to a Ground Lease. This is simply inaccurate. A ground lease typically has increasing payments over time and does not amortize down. With a ground lease, every year that goes by, the ground lease decreases the value of your collateral. With PACE, every year that passes, the outstanding balance of the PACE Assessment goes down, ultimately increasing your value annually. PACE is significantly superior to a Ground Lease from a senior lender’s perspective. If you allow for Ground Leases in your underwriting guide, you should certainly look to allow PACE as a superior structure.

Additionally, I had someone tell me that PACE should be view like a TIF monetization. Again, this comparison doesn’t work. With a TIF monetization, once the TIF Bond has been repaid, you are still stuck with the higher real estate taxes. With PACE, once your assessment amortizes off, the payment goes away.

Frankly – there is no direct comparison between PACE and any other capital structure (perhaps other than real estate taxes themselves).

I like to describe PACE like this: “PACE is an exchange of cash today for increased real estate tax payments for the next 30 years”. In the right scenario, the cash received today is worth more than the decline in value resulting from the higher real estate taxes. That is the ultimate value of PACE and PACE is especially accretive for certain hospitality transactions. PACE should not be viewed as increased leverage. It should be viewed as a value impairment that should be taken into account in a lender’s underwriting. We are not blind to the concept of “operating leverage,” but believe that is an underwriting issue not truly additional leverage.

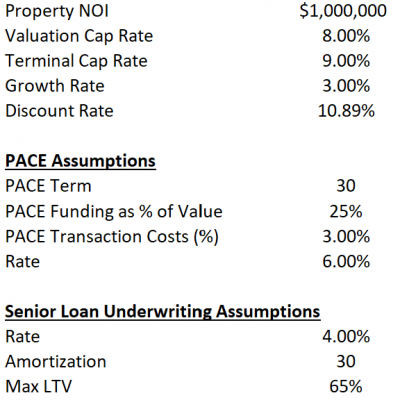

So how do you evaluate PACE. We utilize the following methodology to evaluate a loan being made in a Capital Stack that includes PACE. You can download our model to validate any assumptions [here].

- We include the annual PACE Payment as an additional tax assessment reducing the NOI prior to utilizing a cap rate for our valuation.

- We discount back the incremental value achieved when the PACE loan is repaid (NOI goes up at maturity of the PACE loan by the amount of the PACE Payment)

- The sum of (1)+(2) is our value today. The net property value is less than it would have been without the PACE Funding. However, it should be noted, the gross value (Property Value + the PACE Loan) typically increases.

- The LTV for the senior lender today should be calculated based upon the value achieved in (3)

- The equity required for a transaction should be less so long as the combination of rate and amortization on the PACE Loan is accretive relative to the cap rate on the valuation. Or, the LTV on the senior loan could be lowered reducing risk to the senior lender (higher LTV and DSCR).

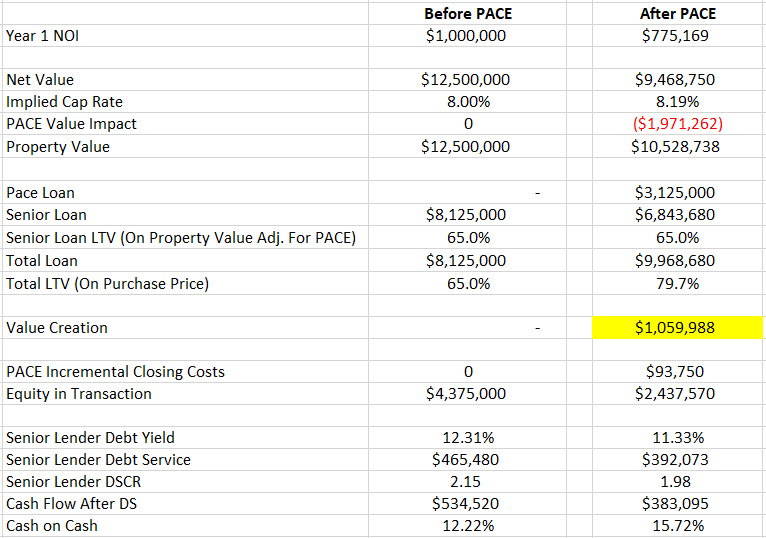

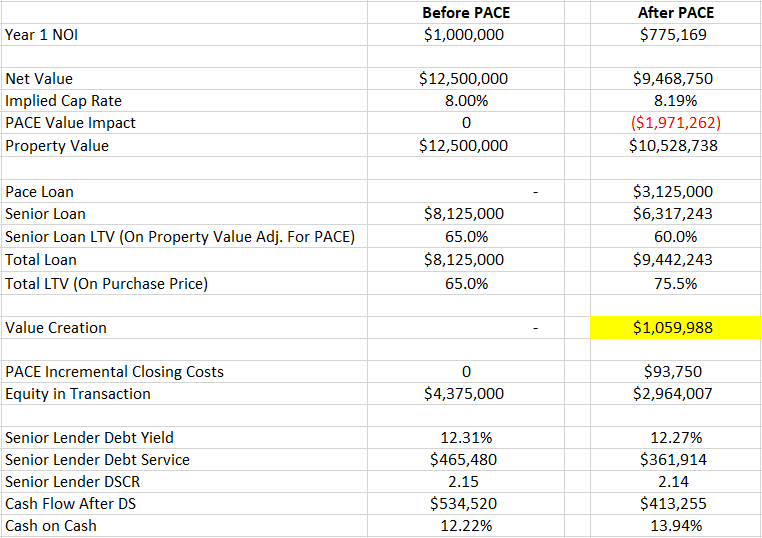

Below are our assumptions and the before and after analysis of the results holding all variables static and adding in a PACE component to a traditional financing. The first Before/After shows the metrics based upon a 65% loan before and after while the second case shows the metrics with a reduced senior lender LTV from 65% to 60% after the PACE financing transaction.

Assumptions:

Before and After Results (Senior Lender LTV Held Static):

Before and After Results (Senior Lender LTV Reduced by 5%):

Scenario Results:

- In both scenarios, less equity is required by the sponsor. In scenario 1, the sponsor equity reduces from 35% to 20% and in scenario 2, the equity is reduced to 25%.

- The Sponsor equity is reduced despite the senior loan remaining at 65% in scenario 1 and reduced to 60% in scenario 2.

- Sponsor cash-on-cash is increased by 3.5% and 1.72% respectively.

- In both scenarios the value of the property increases by just under 9%.

- In scenario 1 (lender LTV remains at 65%), key underwriting metrics of DSCR and Debt yield are slightly inferior. Debt yield drops to 11.33% from 12.31% and DSCR drops from 2.15x to 1.98x. In scenario 2 (lender LTV reduced by 5%), the metrics remain flat in the before and after comparison.

Conclusions:

Ultimately lenders need to make their own conclusions about how they will underwrite transactions with PACE in the stack. But PACE has been misconstrued by many lenders as something that it is not. We view PACE as a financing tool that can enhance value for your clients if underwritten responsibly.

With responsible underwriting, PACE can be utilized to help your clients enhance their returns without a material impact to the risk borne by the senior lender, or in many cases, potentially reducing risk to the senior lender. The critical underwriting metrics including LTV, DSCR, and Debt yield have low to immaterial impacts depending upon the leverage levels allowed by the senior lender.