If you’re new to agency lending or an experienced pro, you likely don’t have a full understanding of the ins and outs of multifamily lending. For one thing, you may be wondering how your broker and lender get paid for their role in originating a Fannie Mae or Freddie Mac loan.

The answer to that question can get a bit confusing. So let’s start with some basic definitions.

There are a variety of parties playing in the agency lending space. Some are lenders. Some are brokers. Some are both. Let’s dive into a who’s who of agency lending. At TermStreet, this is how we break it all down:

1 - Licensed Lender

This is how we refer to a company that functions primarily as a lender but that’s also a Fannie Mae Licensed Lender or a Freddie Mac Licensed Lender. (Note that a Fannie Mae Licensed Lender is known formally as a “Delegated Underwriter and Servicer for Fannie Mae” or “DUS Lender” and that a Freddie Mac Licensed Lender is known formally as a “Freddie Mac Seller Servicer.”)

2 – Licensed Broker

A company in this category functions primarily as a mortgage and/or investment sales broker, But also holds a Fannie Mae and/or Freddie Mac license.

3 – Correspondent Broker

This is a company that has a correspondent relationship with one of the licensed lenders listed as #1 or #2 above. A company like this has no formal arrangement with Fannie Mae or Freddie Mac. Instead, the company has agreed with one of the licensed lenders (#1 or #2 above) to work exclusively with them for a favorable revenue split. You read that correctly – they have signed an agreement to work exclusively with a single Agency Lender! Where’s the competition?

4 - Broker

The fourth category is for those brokers that have no correspondent relationship but that will negotiate on your behalf with licensed lenders—the ones listed as #1 or #2 above.

Who falls into which category?

At this point, it’s natural to want to categorize the lenders you know so you’ll understand where each one fits into the above breakdown.

Let’s take a look at which lenders hold licenses in either Group #1 or Group #2.

| Licensed Lenders (1) | Licensed Brokers (2) |

| Arbor | Bellwether |

| Capital One | Berkadia |

| Chase Bank | CBRE |

| Citi Bank | Colliers |

| Community Capital Corp | Grandbridge |

| Greystone | JLL |

| HomeStreet Bank | Lument |

| Key Bank | M&T Realty Capital |

| PGIM | Newmark |

| PNC | NewPoint |

| Regions | Northmarq |

| Sabal Capital | Walker & Dunlop |

| Wells Fargo |

What about Group 3 and Group 4?

Now that you’ve seen the lenders that fall into the first two groups, you’re probably wondering about the next two groups. Who fits into groups #3 and #4?

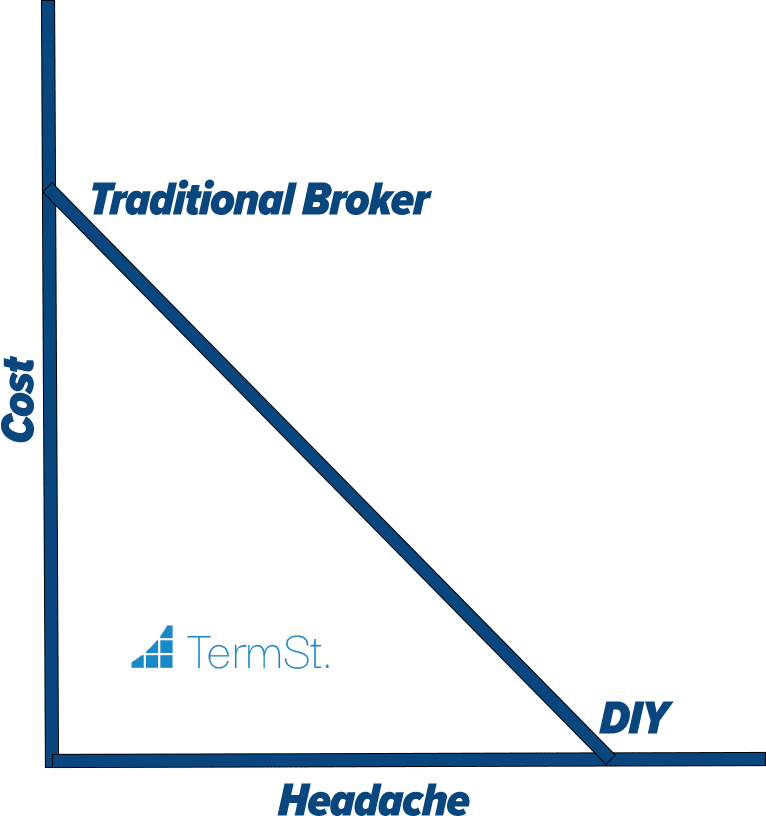

Actually, many brokers fall into these categories. We could try to list some of them, but it doesn’t matter. In our opinion, you should never use any non-licensed traditional broker, even if they tell you they have a “correspondent relationship” with a direct agency lender.

Why shouldn’t you use a non-licensed traditional broker? Because they will add fees to the transaction. Will you see them directly? Maybe not. It might just result in a higher spread. But, take our word for it, if you use a group that falls into our 3rd or 4th categories above (“Correspondent Broker” or “Broker”), you are paying more than you should in total fees, rate, or both. It is simple math—there are more mouths to feed.

So how do the various participants make money?

From the outside it might seem like Fannie Mae & Freddie Mac are similar lenders. For the most part, that’s true. They are similar. However, the way they access the market is materially different.

Fannie Mae

Let’s start by taking a look at Fannie Mae.

Fannie Mae partners with DUS lenders who agree to originate and service loans—and also hold a first loss position in the loans they originate. The DUS lenders don’t actually hold this paper. But in the event of a future loss, they are responsible for covering a portion of that loss before Fannie Mae steps in with its guarantee. DUS lenders need to hold appropriate reserves on their balance sheet—to anticipate and estimate possible future losses.

How the money moves

The DUS Lender is paid an origination fee at closing (there is a minimum fee schedule that must be paid, although it can also often be baked into the rate instead). The lender is also paid a servicing strip that is added to the rate.

The servicing strip is significant as it compensates the lender for taking the first loss position. This is also the point where the lender’s interests and Fannie Mae’s interests align. Fannie Mae is compensated with a fee for providing a guarantee to the investor who acquires the loan.

After closing, the loans are sold off or securitized with this guarantee in place. And they trade with an implied US government guarantee at a slight premium compared to where US government-backed bonds would trade.

For you, this means that your spread over US treasuries is made up of:

- the investor spread,

- a guarantee fee component

- a servicing strip to compensate the DUS Lender, and

- excess premium* (This is profit that can be shared between the DUS Lender and/or Broker or Correspondent Broker.)

*TermStreet Note: Our goal at TermSt. is to make sure that the excess premium is always eliminated through competition.

Freddie Mac

Now that we’ve seen how the participants make money in a Fannie Mae scenario, we can explore Fannie’s counterpart—Freddie Mac.

Freddie Mac gets all of its deals through its partnership with Seller Servicers. As a result, a deal in this scenario is unlike a deal with Fannie Mae DUS Lenders—in one key way. Seller Servicers have no skin in the game.

Instead, they’re purely intermediaries. And they have no true role in making credit decisions about the proposed loan. They present the deal to Freddie, and Freddie provides a loan quote. Freddie securitizes the vast majority of their loans in loan pools where they guarantee a portion of the pool while a b-piece buyer (often one of the large owners of apartment properties) purchases the first loss position of the pool for a premium spread.

How the money moves

As a borrower, your quoted spread on a Freddie Mac loan is made up of three things. First, there’s the pass-through rate to the securitization. Second, there’s a small servicing strip to the Seller Servicer—think 2-3 basis points (.02-.03%). And finally, there’s excess premium* allocated to the Seller Servicer and the Broker/Correspondent Broker.

Fannie Mae vs. Freddie Mac: Other differences

As we mentioned above, Fannie Mae lenders have a role in the credit decisions on the loans they originate—because they hold a first loss position. This gives the lenders more autonomy to underwrite and close loans without input from Fannie Mae.

It’s vital for you, as a borrower, to understand this point and its impact. You might get 3 or 4 different quotes from 3 or 4 different agency lenders because they overlay their own credit standards on top of the existing deal. This is exactly why it’s important to get multiple Fannie Mae quotes to ensure you are appropriately clearing the market.

Freddie Mac is a little bit trickier because Freddie will only provide a quote through a single Seller Servicer. This is why you need to get soft quotes before you pick a Seller Servicer to represent you. And that can be challenging because the lenders don’t really have credit autonomy. Ultimately, they need to go to Freddie to get their final answer.

Still, if you pick a lender who’s bullish on a particular market, deal, or sponsor, they’ll certainly craft their presentation in the most positive light possible.

At TermStreet, we like to work with 2 Freddie Mac Lenders and 3 Fannie Mae lenders on all multifamily financing transactions. That way, we shake out the best possible terms.

Top takeaways for borrowers

At the end of the day, if you’re a borrower, here’s what you need to walk away knowing:

- You probably need to talk to 3 Fannie Mae and 2 Freddie Mac lenders on each deal to feel like you’ve cleared the market and perfected your loan terms. While there could be crossover on these lenders (some lenders have both a Freddie & Fannie License), at TermSt. we prefer to give each lender either Fannie or Freddie, not both. This ensures maximum competition.

- If a broker tells you that they are a “correspondent” for a licensed agency lender, you are going to end up paying double fees—no matter what they tell you.

- Brokers that have an agency license are not completely aligned with your interests. Plus, they don’t have access to the entire universe of lenders. And this is especially true when it comes to bridge loans, where the most competitive bridge quotes will often come from another competitive agency lender with access to proprietary balance sheet capital.

- At TermStreet, we argue that apartment finance is all about the Quid Pro Quo. What this means is that you should always be getting something beyond a closed loan. This could be access to low-rate and/or high leverage balance sheet capital for bridge of construction loans or it could mean access to deal flow. We blogged about the Quid Pro Quo inherint in multifamily finance and long story short, you must decide what is important to you beyond your next transaction when picking a lender.

Now you can walk away with these bullets in mind. And they’ll help provide a well-rounded perspective to your apartment financing process.

But another alternative is to ditch these three points and zero in on one simple takeaway instead: The only way to get the benefit of true alignment of interests is to utilize the TermStreet Platform. TermStreet grants you access to the widest range of lenders possible, and that competitive environment perfects your terms. If you’d like to take a look to really get a feel for what we mean, we can schedule a demo for you today.