Multifamily Finance is All About the Quid Pro Quo

Quid pro quo is a Latin phrase that means “this for that.” And it describes the concept of getting something in return. When we use it in the context of multifamily finance, we’re talking about getting a return from your lender above and beyond a single closed loan.

With Agency Financing (that is Fannie Mae or Freddie Mac), choosing a lender is all about the quid pro quo. There are a bunch of good lenders and they all mostly provide a good quality of service and have generally the same product. So how do you pick a lender to work with?

Quid pro quo and choosing an apartment lender

First, know that agency lending is very lucrative for the lenders who participate. Naturally, they aggressively pursue this business. And each lender has its own tool belt that it provides in an attempt to win customers, deals, and market share. The lender is essentially offering you the proverbial cherry on top.

Here are a few of the most common Quid Pro Quo scenarios in apartment financing transactions:

1 – Your Agency Lender is an investment sales broker

Whether stated or not, you have a better chance to get into the best and final round and get good pricing feedback if you are also working with their multifamily finance team on your financing. This is especially true if you are a smaller market participant. You should always keep this in mind when bidding on marketed multifamily deals.

2 – Your Agency Lender is a balance sheet lender

Whether stated or not, you have a better chance to get into the best and final round and get good pricing feedback if you are also working with their multifamily finance team on your financing. This is especially true if you are a smaller market participant. You should always keep this in mind when bidding on marketed multifamily deals.

How are you picking your multifamily lending partners today?

Ultimately, you just want to look for a lender who can offer you a lending experience that’s worth your while. You may find a lender who is a cut above because of the quality of their process and the quality of their service. (Although ruling out options based on these quality metrics is actually harder than you might imagine because most of the lenders are pretty good).

On the other hand, the simple fact that a potential lender is a childhood friend, former college roommate, or golf buddy may be what tips the scales in their favor. But regardless of the exact scenario, the point is that you’re always seeking a setup in which you get something worthwhile in exchange for the lucrative loans you deliver to your chosen Fannie Mae or Freddie Mac lending partners.

Why quid pro quo matters

The bottom line here is that you need to be able to get more than just a closed loan from your agency lending partners. Multifamily lending is a two-way street. You shouldn’t be giving your valuable business to lenders who aren’t giving you back something of value in return.

If you are a multifamily borrower, and you’re not getting your quid pro quo, think about what you’d like from your lender and ask for it (or find a lender that will give it to you).

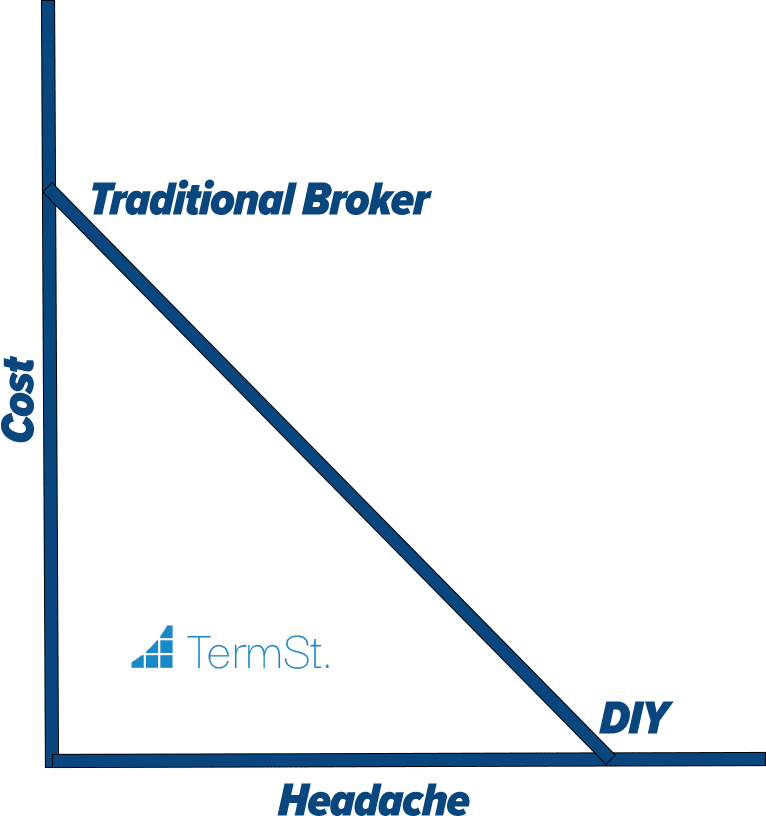

At TermStreet, we hold your lenders accountable to the Quid Pro Quo. And our process and fee structure ensures you get the best deal available in the market, whether that is a Fannie Mae, Freddie Mac, or some other offering from the wide universe of apartment lenders.