Agency Financing - Why is it so important to the apartment financing market?

When we refer to agency financing, we’re talking about loans from Fannie Mae (“Fannie”) and Freddie Mac (“Freddie”). As an apartment owner, you’re probably already aware of the importance of agency financing to the overall apartment financing market. But in this article, we want to give you more clarity on how agency financing works. And we’ll help you understand the best way to access this type of financing.

A better way to find the best options

We’ll begin by stealing our own punchline. You may not be accessing the market in the most effective and lowest-cost manner.

If you’re reading this and finding that your interest is piqued, we at TermStreet want to invite you to join the 0.03% Club. Learn more about TermStreet’s proprietary multifamily lending program here.

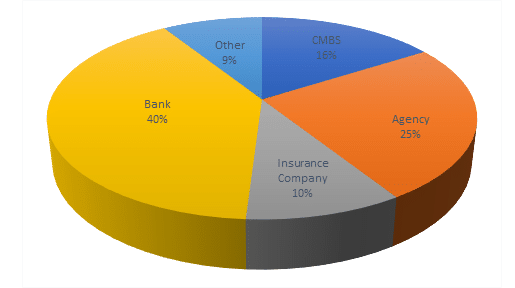

Let’s kick-start this whitepaper by taking a look at the overall financing market. We’ll start with a graph because visuals are a great way to form an initial understanding of the “big picture.” In any given year, the total mortgage volume looks something like the chart below. (Note that volume is growing over time, so this is really a ballpark estimate.)

The state of Fannie Mae and Freddie Mac financing

In 2020, total Fannie Mae production was $76 billion and Freddie was $83 billion. This is $159 billion financed by the agencies against total multifamily lending in the U.S. among all lenders at $300 billion. Together, the agencies made up 50% of all multifamily financing—and more than 25% of all commercial real estate loans closed in the year 2020 (and in all other years in recent history, too, for that matter).

These two agency lenders provide high leverage financing (up to 80% LTV) at low rates. For the universe of “Other Lenders” out there, it’s very hard to compete against these agencies and actually win deals.

What does all of this mean for the market? Overall, it means that the apartment market has stable and recession-proof access to capital. In good times and in bad, Fannie and Freddie show up, compete against each other, and ensure that there is liquidity for multifamily acquisitions and refinances.

This props up apartment values, drives down rates, and puts downward pressure on cap rates. It means that the long-term bet in the sector is bullish—in large part because of debt market liquidity driven by access to agency financing that’s not available in any other sector.

Accessing the Market for Fannie & Freddie Loans

The setup we see right now is unlike any other type of capital in the real estate capital markets. Fannie Mae and Freddie Mac (and ultimately the federal government) have granted oligopoly power to a select group of 25 license holders, allowing them to be the sole providers of capital.

Note that we’re not going to get political here. Instead, we’ll stick with facts. And as to the debate about how the agencies should operate within the markets—we’ll save that for a future blog post.

What makes accessing the market for Fannie Mae and Freddie Mac financing so different from any other type of commercial real estate loan search is that ultimately you’re choosing your lender before you get a quote. That means you’re assuming the lender you choose to take you to Fannie Mae and Freddie Mac will get you the best possible deal. And you’re also assuming that all providers are made equal. Nice assumptions—if they were true.

At TermStreet, we believe that you’ll never get the best possible deal without competition. No lender leans into underwriting, credit, pricing, and structure unless market pressures force them to do so. So picking your lender before you create competition is a mistake in nearly every scenario.

Also, it’s important to understand the structural differences between Fannie and Freddie. Grasping these differences help identify the process you should use to create competition. So we’ll explore these two lenders below.

Understanding Fannie Mae

First, we’ll take a look at Fannie Mae. Then move on to Freddie Mac. Assessing both in turn should give you a feel for how they’re unique.

In the market, a Fannie Mae license-holder is called a DUS Lender—or a Delegated Underwriter and Servicer if you want to get technical about it.

The name itself leads us to one of the important differences between Fannie & Freddie. DUS Lenders have significant autonomy to underwrite, quote, and structure deals so long as the underwriting, structuring, and pricing fit “in the box” so to speak. The lenders are granted this autonomy because they hold a first loss position for the loan on their balance sheet.

This is important because it forces these lenders to overlay their own credit standards on the loan. In the market you’ll find certain variations in how transactions are handled—one DUS Lender will cap the proceeds at 70% of value, another lender will hold steady at the Fannie Mae cap of 80%. The same is true for the quoted amortization, interest-only period, the reserves to be held, etc. This credit overlay might even impact the ultimate rate on the loan.

In many cases, all of this underwriting, structuring, and quoting we’ve just been talking about can happen before the DUS Lender even talks to Fannie Mae about the loan. In fact, DUS Lenders are fully capable of closing and delivering a loan to Fannie Mae without ever actually presenting the loan to Fannie. But that’s only allowed as long as all of the metrics fit within Fannie Mae’s box.

Once you know this, you have to ask: Why would you want that deal? The primary goal of the loan solicitation process is to create competition that forces the lender to actually approach Fannie Mae and request waivers to their standard underwriting. Why? Because that directly leads to lower DSCR hurdles, higher LTV, a longer interest-only period or a better.

The difficulty with Fannie Mae

The challenge here is that Fannie Mae will only work with a single DUS lender on any given deal. If more than one lender presents the deal and asks for waivers, Fannie will do nothing until the borrower formally chooses a single lender.

If you’re the borrower in a lending situation, what you have to do is engage more than one DUS Lender to get a soft quote before you select a lender to handle the loan formally with Fannie Mae. It’s your job to know that this quote is soft. It’s not a guarantee because your selected DUS Lender just may not be able to get all of the waivers they quoted you. (For DUS Lenders, believing you can get a waiver and actually getting it aren’t always the same thing.) So until you hear back from Fannie Mae, just know that the terms are not final.

Even so, at the end of the day, would you rather ask for 2 years of IO and get 2, or request 6 and get 4? It’s not a complicated decision. Overall, don’t view this as a “retrade,” just see it as part of the process of closing a loan with the best possible terms.

At TermStreet, we like to get soft quotes from three Fannie Mae DUS Lenders before we choose a horse. That’s enough to create competition and to find the most aggressive lender for that particular situation.

Understanding Freddie Mac

Freddie Mac has a simpler process than Fannie Mae. Freddie Mac calls their license holders Freddie Mac Seller Servicers. These lenders do not have a formal role in underwriting or credit. So the loan is presented to Freddie to underwrite and quote. All structuring and pricing steps are completed within a Freddie Mac office. And any “waivers” from the box are approved during this process.

This makes dealing with Freddie Mac easier—and harder—than dealing with Fannie Mae. Ultimately, it’s much more challenging to create any real competition between Freddie Mac lenders than it is between Fannie Mae lenders.

Like Fannie Mae, Freddie will only deal with a single Seller Servicer on any particular deal. Does it still make sense to get a soft quote from more than one Freddie lender? Absolutely it does. But, ultimately, the overriding credit decision resides with Freddie, and there shouldn’t be much variation in your quote based on who you choose. At TermStreet, we still like to get soft quotes from more than one lender to start with—but we typically stick to just two.

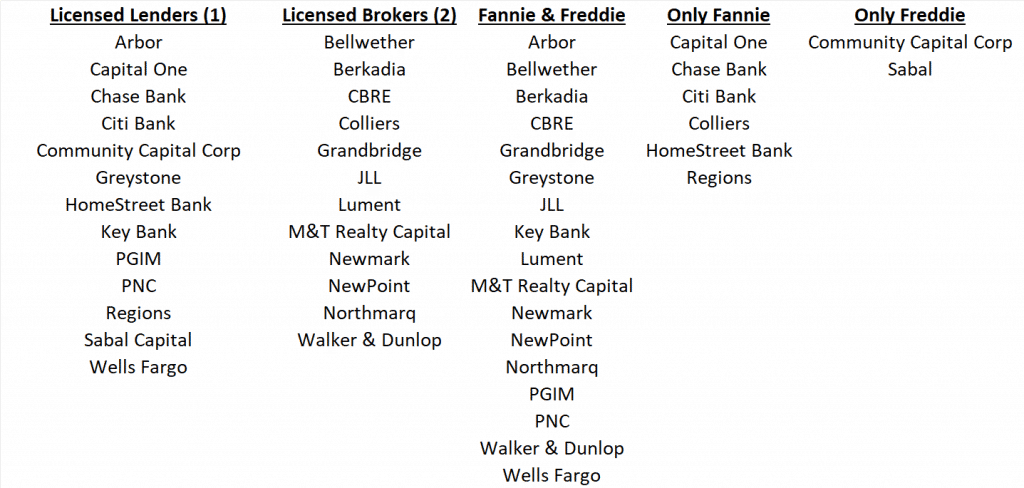

The Agency Financing Players

Now that we’ve taken a look at the market, we need to turn to identifying the players in the market. Who are they, and how can you differentiate between them? There are a variety of parties playing in the agency lending space. Some are lenders. Some are brokers. Some are both. At TermStreet, this is how we break it down:

1 - Licensed Lender

This is how we refer to a company that functions primarily as a lender but that’s also a Fannie Mae Licensed Lender or a Freddie Mac Licensed Lender. (Note that a Fannie Mae Licensed Lender is known formally as a “Delegated Underwriter and Servicer for Fannie Mae” or “DUS Lender” and that a Freddie Mac Licensed Lender is known formally as a “Freddie Mac Seller Servicer.”)

2 – Licensed Broker

A company in this category functions primarily as a broker. But it also holds a Fannie Mae and/or Freddie Mac license.

3 – Correspondent Broker

This is a company that has a correspondent relationship with one of the licensed lenders listed as #1 or #2 above. A company like this has no formal arrangement with Fannie Mae or Freddie Mac. Instead, the company has agreed with one of the licensed lenders (#1 or #2 above) to work exclusively with them for a favorable revenue split. You read that correctly – they have signed an agreement to work exclusively with a single agency lender. Where’s the competition?

4 - Broker

The fourth category is for those brokers that have no correspondent relationship but that will negotiate on your behalf with licensed lenders—the ones listed as #1 or #2 above.

Who’s who | Visualized

Breaking down the Licensed Lenders and Brokers and identifying which licenses they hold can be helpful to truly understand what companies are at work in the agency lending space. Here’s a categorized list (note that companies are listed alphabetically).

Understanding Correspondent Brokers and Brokers

Now that you’ve seen the lenders that fall into the “Licensed Lender” and “Licensed Broker” categories, you’re probably wondering about the next two groups. Who fits into groups #3 and #4?

Actually, many brokers fall into these categories. We could try to list some of them, but it doesn’t matter. In our opinion, you should never use any non-licensed traditional broker, even if they tell you they have a “correspondent relationship” with a direct agency lender.

Why shouldn’t you use a non-licensed traditional broker? Because they will add fees to the transaction. Will you see those fees directly? Maybe not. It may only result in a higher spread. But, take our word for it, if you use a group that falls into our 3rd or 4th categories above (“Correspondent Broker” or “Broker”), you are paying more than you should in total fees, rate, or both. It is simple math—there are more mouths to feed.

The Quid Pro Quo of Agency Financing

At this point, you understand the market. You understand its players. But you may still be hung up on how you pick a lender (or lenders).

Picking your agency lender is about more than getting the best terms each time you go to the market. Closing agency loans is extremely lucrative to the various participants. This is because of the arbitrage profit to the transactions.

Agency Lenders are closing these deals without putting their corporate balance sheets to work (except for the relatively minimal first loss reserves held by DUS Lenders). For these lenders, the IRR on these loans is nearly infinite.

The desirability of these loans has forced lenders to get creative when it comes to attracting and retaining borrowers. Each lender has a tool chest that it uses. At TermStreet, we call this the quid pro quo of agency financing. If you’re an agency borrower, are you getting just your agency loan, or are you getting something more?

Here are some of the bigger opportunities we’re talking about when we refer to “getting something more.” They’re easiest to understand in terms of real-life lending scenarios, so take a look at these.

Scenario 1: You’re working with an investment sales broker

Whether stated or not, you have a better chance to get into the best and final round and get good pricing feedback if you are also working with the sales broker’s multifamily finance team on your financing. This is especially true if you are a smaller market participant. You should always keep this in mind when bidding on marketed multifamily deals.

Scenario 2: You’re working with a balance sheet lender

If your agency lender is also a life insurance company or a bank, or if they have raised proprietary capital to lend they may be able to offer you lending options that are challenging to get in the market—like high leverage construction loans, aggressive bridge loans, or an acquisition credit facility. What non-agency lending options might benefit you?

Other scenarios

On the other hand, the simple fact that a potential lender is a childhood friend, former college roommate, or current golf buddy may be what tips the scales in their favor. But regardless of the exact scenario, the point is that you’re always seeking a setup in which you get something worthwhile in exchange for the lucrative loans you deliver to your chosen Fannie Mae or Freddie Mac lending partners.

Ultimately, you just want to look for a lender who can offer you a lending experience that’s worth your while. You may find a lender who is a cut above because of the quality of their process and the quality of their service. (Although ruling out options based on these quality metrics is actually harder than you might imagine because most of the lenders are pretty good).

Hold your lenders accountable

If you’re an agency borrower, and you’re not getting your quid pro quo, think about what you’d like out of your lender and ask for it (or find a lender that will give it to you). Always evaluate whether you are getting the right quid pro quo for your business.

So how do the various participants make money?

From the outside it might seem like Fannie Mae & Freddie Mac are similar lenders. For the most part, that’s true. They are similar. However, the way they access the market is materially different.

Fannie Mae

Let’s start by taking a look at Fannie Mae.

Fannie Mae partners with DUS lenders who agree to originate and service loans—and also to hold a first loss position in the loans they originate. The DUS lenders don’t actually hold this paper. But in the event of a future loss, they are responsible for covering a portion of that loss before Fannie Mae steps in with its guarantee. DUS lenders need to hold appropriate reserves on their balance sheet—to anticipate and estimate possible future losses.

How the money moves in a Fannie Mae deal

The DUS Lender is paid an origination fee at closing (there is a minimum fee schedule that must be paid, although it can also often be baked into the rate instead). Additionally, the lender is paid a servicing strip that’s added to the rate.

The servicing strip is significant as it compensates the lender for taking the first loss position. This is also the point where the lender’s interests and Fannie Mae’s interests align. Fannie Mae is compensated with a fee for providing a guarantee to the investor who acquires the loan.

After closing, the loans are sold off or securitized with this guarantee in place. And they trade with an implied US government guarantee at a slight premium compared to where US government-backed bonds would trade.

For you, this means that your spread over US treasuries is made up of:

- the investor spread,

- a guarantee fee component,

- a servicing strip to compensate the DUS Lender, and

- excess premium* (This is profit that can be shared between the DUS Lender and/or Broker or Correspondent Broker.)

Freddie Mac

Now that we’ve seen how the participants make money in a Fannie Mae scenario, we can explore Fannie’s counterpart—Freddie Mac.

Freddie Mac gets all of its deals through its partnership with Seller Servicers. As a result, a Freddie deal is unlike a deal with Fannie Mae DUS Lenders—in one key way. Seller Servicers have no skin in the game.

Instead, they’re purely intermediaries. And they have no true role in making credit decisions about the proposed loan. They present the deal to Freddie, and Freddie provides a loan quote. Freddie securitizes the vast majority of their loans in loan pools where they guarantee a portion of the pool while a b-piece buyer (often one of the large owners of apartment properties) purchases the first loss position of the pool for a premium spread.

How the money moves in a Freddie Mac deal

As a borrower, your quoted spread on a Freddie Mac loan is made up of three things. First, there’s the pass-through rate to the securitization. Second, there’s a small servicing strip to the Seller Servicer—think 2-3 basis points (0.02-0.03%). And finally, there’s excess premium* allocated to the Seller Servicer and the Broker/Correspondent Broker.

*TermStreet Note: TermStreet ensures that the excess premium is eliminated through competition.

You Are Sourcing Your Agency Financing Wrong

Earlier, you learned how we at TermStreet categorize the different types of agency lenders. To recap, think of two classes of companies. In one class, you’ll find the companies that function primarily as lenders. They’ll hold one or both agency licenses, and mostly they’ll be banks and life insurance companies.

In the second class, you’ll find companies that function primarily as brokers. These companies will hold agency licenses, and they’ll often be investment sales brokers or mortgage brokers.

The bottom line is that to access Fannie Mae or Freddie Mac for your next apartment financing transaction, you’ll need to use a company that falls into one of these classes.

Here at TermStreet, we believe that you’ve been accessing the lenders wrong. As an informed borrower, you deserve to understand what we mean by that. So let’s back up and explain.

Three ways to access lenders

Naturally, there’s more than one way to access the lenders you need for multifamily financing. There are at least three different ways.

1 - Access lenders directly (without any brokerage assistance)

First up is accessing your lenders without engaging assistance from a broker. Think of this as direct access. The problem with this approach is that it’s a broken methodology. Why? First because in order to clear the market, you need to go to at least 2 Freddie Mac lenders and 3 Fannie Mae lenders (that’s how we handle it at TermStreet anyway).

And second because while you’re busy with your 2 Freddie and 3 Fannie lenders, there are hundreds of life insurance companies, banks, debt funds, mortgage REITs, and credit unions out there that might be interested in providing better terms for you than you will find from those agencies. Do you know how to find and interact with all of these lenders? And do you have the resources internally to manage such an exhaustive process? Almost no one does.

2 – Hire a broker without an agency license

In this scenario, you’ve decided not to take the direct access route but instead to hire a broker. Let’s assume you want to hire a broker that does not have an agency license. It sounds great until you realize that these brokers typically try to hide their fees in the deals.

Will you see an increase in your fees? No. But you’ll be paying a higher rate whether you see it or not. That’s because, for these brokers, the increased fee is baked into the rate. It may not seem like a big deal, but on a 10-year loan, even a 1% fee increases your rate by about 14 basis points (0.14%). And on a 5-year loan, the rate increase is going to be about 22 basis points (0.22%).

What you might hear from these brokers is that they’re just correspondents. Something like, “We’re just sharing the fees or premium that would normally be baked into the deal. So there’s really no cost to the borrower.”

That would be great if it were true. But it’s not.

When you put a deal into a situation where the agencies are forced to compete to win (and you should always make your lenders compete), the Agency Lenders cap the fee amount that can be paid out of the deal. So there’s just no way to both create competition and pay dual fees out of ordinary transaction premium.

Of course, the good news here is that this broker is likely experienced and capable of getting you to the rest of the universe of lenders that might be interested in your deal. But it’s a lot of work to do that. And your broker may be more motivated to just take the easy fee and let the agencies win your deal even though there might be something better out there.

At TermStreet we believe in creating the proper set of incentives to align the interests of all parties in a transaction.

3 – Hire a broker with an agency license

At this point, you might be thinking, “Okay, I get it. I don’t want to pay double fees. So, I’ll hire a broker who does have an agency license for my next apartment transaction. That way, the broker can handle the agencies, and they can also get me access to the universe of non-agency lenders.”

This is a very reasonable plan. That said, there are a couple of challenges here as well:

- First, these brokers are not going to get you competitive agency quotes. So you’ll either need to do that yourself or trust that these lenders don’t need a competitive environment to get the best possible terms on a loan request.

- Second, these brokers do not have access to the entire universe of other lenders. Most of the agency lenders have developed bridge-to-agency programs or other programs that create quid-pro-quo relationships—ensuring future agency business. These are often the most competitive programs to agency quotes. The agency brokers do not play well in the sandbox together so you will not see quotes from these competitive agency lenders when hiring one of these brokers.

- Third, these agency brokers get paid better (better fees, better servicing, better premium) if they direct you to one of the agency lenders. Ultimately, that means they may not be motivated to find you the most competitive quotes from the wide world of non-agency lenders.

Choosing your route

So where does all this leave you? Well, the good news is that you’re going to get pretty amazing terms no matter where you go—because there’s incredible liquidity in the multifamily finance space. Still, if you want to be sure you are getting the best deal available, the only surefire way to do that is to execute through the TermStreet Marketplace, where you can be sure our incentives are perfectly aligned with yours.

The TermStreet Difference

The final option here is one born out of our own experience doing business “the usual way” and finding it lacking. TermStreet enables you to go to the agency lenders of your choosing (we recommend 3 Fannie Mae and 2 Freddie Mac lenders) for soft quotes.

Then, if you execute your process through our platform, using our communication tools, we’ll engage the rest of the universe of lenders to view your deal on the platform, share the same communications, tackle questions and answers, and review the same diligence—with little or no extra effort on your part.

If you end up executing with one of the agency lenders, the lender pays us no more than a 0.03% fee out of their servicing strip (no excess premium, no backend, just the strip). If, on the other hand, we find you a non-agency lender to do your deal, you pay us our fee at closing.

In reality, this strip fits within the servicing strip paid to the DUS Lender or Seller Servicer. So, ultimately, it may end up costing you nothing. For TermStreet, it compensates us just a bit to cover what it costs us in time and technology to get your deal prepped for successful execution.

TermStreet Technology

At TermStreet, we’ve taken the best elements of powerful platforms you already use and love, and we’ve rebuilt them for a transactional marketplace. Our technology leverages the same strengths you’ll find in your favorite cloud, social, or file-sharing applications.

Like LinkedIn, we help you connect with the right people. This plugs you into the right capital source for your deal and helps you build your network of capital partners.

Similar to Slack, our platform sets you up to communicate easily with all of the lenders participating in your financing request. Every communication can be shared effortlessly with the entire community, a small group within the community, or just one lender. With a simple mouse click, you determine who gets to see what.

Just like DropBox, we offer secure file sharing for every file you might send.

Similar to Salesforce, our tech allows you to know who’s accessing your deal and how often. This gives you a better sense of who’s most interested.

Better than Excel, our technology automatically creates a matrix to help you analyze and compare each of your quotes. This means your analyst can stop doing it the manual way (the way they’re probably doing it right now).

All of these tools were built to integrate seamlessly, creating the least expensive and most efficient way to access available capital for your multifamily deals.

But you don’t have to take our word for it. You can schedule a [demo] if you want to take a look for yourself.

TermSt. Process

TermStreet is more than just technology. Our team has closed billions of dollars in transactions. And we have the underwriting chops to understand your deal and to get it in front of those lenders who’ll bid aggressively on it.

Here is the step-by-step process that TermStreet uses for each deal in its multifamily program:

- A user fills out the TermStreet Application (it takes 15 minutes).

- TermStreet analysts review the application and size the transaction in our proprietary sizing model. Ultimately, this sizing model is provided to all of the lenders assigned to your deal.

- We schedule a call to better understand your needs and to pick a lender pool.

- Your deal is launched on the TermStreet Multifamily Marketplace, visible to the agency lenders that we’ve selected together.

- You respond to diligence requests and answer questions, expanding the information available to all lenders in the portal.

- Several days after launching to the agency lenders, we open the deal to the remaining lenders on our list.

- You continue to respond to diligence requests.

- Once we receive the agency term sheets, feedback is given to the non-agency lending community about the terms it will take to win (i.e. the winning agency lender becomes the stalking horse).

- Term Sheets are received from non-agency lending universe.

- You negotiate with all of the lenders through the TermStreet Marketplace (or on the phone or via Zoom if preferred).

- You select a lender and sign a loan application.

- Finally, you close your loan.

TermStreet’s multifamily program and its fees

At TermStreet, we’re asking our clients to join the 0.03% club. Does this sound exclusive? Probably. But really all it takes to join is a willingness to think differently about your multifamily financing experience. And, of course, it takes a corresponding willingness to get best-in-class execution, paying only 0.03% on your agency execution.

This 0.03% is paid by the lender. And neither you nor the lender pays any other fees or backend. Better yet, because this fee is so small, the lender is capable of taking it out of their servicing strip. So in reality, this “fee” may end up costing you nothing in a competitive environment.

Zero Conflicts of Interest

Obviously, any scenario where you don’t have to pay the fee sounds attractive (and possibly too good to be true). So how does it actually work?

TermStreet developed this program as the only multifamily financing program in the industry that has zero conflicts of interest. Our only interest, like yours, is to ensure that you find the absolute best multifamily financing terms—whether your next loan comes from Fannie Mae, Freddie Mac, a life company, debt fund, bank, credit union, or any other lender.

With TermStreet, you only pay for value-added

Most brokers could never afford to take on assignments that only pay 0.03%. At TermStreet, we’re built differently. Our technology empowers our clients to engage more lenders in less time. The point is to completely revamp the multifamily borrowing experience.

We begin with 3-5 Fannie Mae and Freddie Mac lenders. This ensures that you get well-thought-out and competitive agency quotes. At the same time, we engage top life insurance, bank, and debt fund lenders using your best agency quotes as the stalking horse.

If we can beat your agency quotes, you pay us our full fee (see table below). If we can’t, you close your Fannie Mae or Freddie Mac loan, and your lender pays us a servicing strip of no more than 0.03%.

Simplicity wins

The Term Street program is simple. It’s low cost. It’s efficient. It’s free of conflicts of interest. There is simply no better platform for multifamily lender engagement. But you don’t have to take our word for it. Instead, go ahead and schedule a demo so you can take a look for yourself.

Full TermStreet fee schedule

| Loan Size | Fee | Min Fee | Max Fee |

|---|---|---|---|

| <$3 million | 1.0% | $25,0000 | NA |

| $3-10 million | 0.75% | $25,000 | NA |

| $10-25 million | 0.60% | $75,000 | NA |

| $25 million+ | 0.40% | $150,000 | $250,000 |