The Apartment Finance Process Is Broken (But Your Approach Doesn’t Have To Be)

As a multifamily borrower, chances are, there is a flaw in your approach to getting quotes from Fannie Mae & Freddie Mac. Here’s why.

If you’ve been following our TermStreet blog, you already know how we categorize the e Mac). To recap, think of two classes of companies. In one class, you’ll find the companies that function primarily as lenders. They’ll hold one or both agency licenses, and mostly they’ll be banks and life insurance companies.

In the second class, you’ll find companies that function primarily as brokers. These companies will hold an agency license, and they’ll often be investment sales brokers or mortgage brokers.

The bottom line is that to access Fannie Mae or Freddie Mac for your next apartment financing transaction, you’ll need to use a company that falls into one of these classes.

Here at TermStreet, we believe that you’ve been accessing the lenders wrong. As an informed borrower, you deserve to understand what we mean by that. So let’s back up and dive into an explanation.

Three ways to access lenders

Naturally, there’s more than one way to access the lenders you need for multifamily finance. So let’s take a look at the three different ways.

1 - Access lenders directly (without any brokerage assistance)

First up is accessing your lenders without engaging assistance from a broker. Think of this as direct access. The problem with this approach is that it’s a broken methodology. Why? First, because in order to clear the market, you need to go to at least 2 Freddie Mac lenders and 3 Fannie Mae lenders (at least that’s how we handle it at TermStreet).

And second because while you’re busy with your 2 Freddie and 3 Fannie lenders, there are hundreds of life insurance companies, banks, debt funds, mortgage REITs, and credit unions out there that might be interested in providing better terms for you than you will find from those agencies. Do you know how to find and interact with all of these lenders? And do you have the resources internally to manage such an exhaustive process? Almost no one does.

2 – Hire a broker without an agency license

In this scenario, you’ve decided not to take the direct access route but instead to hire a broker. Let’s assume you want to hire a broker that does not have an agency license. It sounds great until you realize that these brokers typically try to hide their fee in the deal.

Will you see an increase in your fees? No. But you’ll be paying a higher rate whether you see it or not. That’s because, for these brokers, the increased fee is baked into the rate. It may not seem like a big deal, but on a 10-year loan, even a 1% fee increases your rate by about 14 basis points (0.14%). And on a 5-year loan, the rate increase is going to be about 22 basis points (0.22%).

What you might hear from these brokers is that they’re just correspondents. Something like, “We’re just sharing the fees or premium that would normally be baked into the deal. So there’s really no cost to the borrower.”

That would be great if it were true. But it’s not.

When you put a deal into a situation where the agencies are forced to compete to win(and you should always make your lenders compete), they cap the amount of fee that can be paid out of the deal. So, there is just no way to both create competition and pay dual fees out of ordinary transaction premium.

Of course, the good news here is that this broker is likely experienced and capable of getting you to the rest of the universe of lenders that might be interested in your deal. But it’s a lot of work to do that. And your broker may be more motivated to just take the easy fee and let the agencies win your deal even though there might be something better out there.

At TermStreet we believe in creating the proper set of incentives to align all parties interests in a transaction.

3 – Hire a broker with an agency license

At this point, you might be thinking, “Okay, I get it. I don’t want to pay double fees. So, I’ll hire a broker who does have an agency license for my next apartment transaction. That way, the broker can handle the agencies, and they can also get me access to the universe of non-agency lenders.”

This is a very reasonable plan. That said, there are a couple of challenges here as well:

- First, these brokers are not going to get you competitive agency quotes. So you’ll either need to do that yourself or trust that these lenders don’t need a competitive environment to get the best possible terms on a loan request.

- Second, these brokers do not have access to the entire universe of other lenders. Most of the agency lenders have developed bridge-to-agency programs or other programs that create quid-pro-quo relationships—ensuring future agency business. These are often the most competitive programs to agency quotes. The agency brokers do not play well in the sandbox together so you will not see quotes from these competitive agency lenders when hiring one of these brokers.

- Third, these agency brokers get paid better (better fees, better servicing, better premium) if they direct you to one of the agency lenders. Ultimately, that means they may not be motivated to find you the most competitive quotes from the wide world of non-agency lenders.

Choosing your route

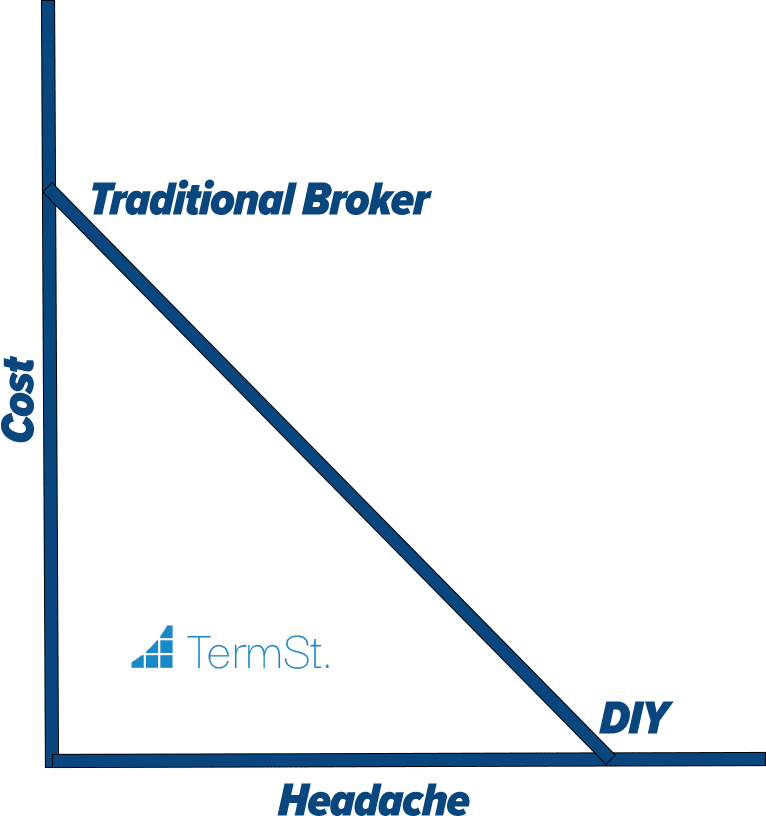

So where does all this leave you? Well, the good news is that you’re going to get pretty amazing terms no matter where you go—because there’s incredible liquidity in the multifamily finance space. Still, if you want to be sure you are getting the best deal available, the only surefire way to do that is to execute through the TermStreet Marketplace, where you can be sure our incentives are perfectly aligned with yours.

Perfectly Aligned Incentives with TermStreet

The final option here is one born out of our own experience doing business “the usual way” and finding it lacking. TermStreet enables you to go to access the agency lenders of your choosing (we recommend 3 Fannie Mae and 2 Freddie Mac lenders) for soft quotes.

Then, if you execute your process through our platform, using our communication tools, we’ll engage the rest of the universe of lenders to view your deal on the platform, share the same communications, tackle questions and answers, and review the same diligence—with little or no extra effort on your part.

If you end up executing with one of the agency lenders, the lender pays us a 0.01% fee out of their servicing strip (no excess premium, no backend, just the 0.01% strip). If, on the other hand, we find you a non-agency lender to do your deal, you pay us our fee at closing.

Business as usual isn’t always best

The goal of the TermStreet Marketplace is to expose your apartment financing transaction to the widest range of options possible. “The usual way” is just that—the usual way. It may not be the only way or even the best way. We want you to have the best options possible. That’s why we’re leaning into the potency of choice and tapping into the power of competition in the multifamily lending space.