TermStreet Multifamily Program | Pay Only For the Value Added

Before you dive into any financial dealing, you want to be sure you understand as much as possible about how all of the parties in the transaction are compensated. When it comes to multifamily financing, you want a heads up at the outset about any fees you’ll be paying (and probably any fees others will be paying as well). So let’s take a look at how the fees work here at TermStreet and with our lending partners.

Financing differently

At TermStreet, we’re asking our clients to join the 0.01% club. Does this sound exclusive? Probably. But really all it takes to join is a willingness to think differently about your multifamily financing experience. And, of course, it takes a corresponding willingness to get best-in-class execution, paying only 0.01% on your agency loan closing.

This 0.01% is paid by the lender. And neither you nor the lender pays any other fees or backend. Better yet, because this fee is so small, the lender is capable of taking it out of their servicing strip. So in reality, this “fee” may end up costing you nothing in a competitive environment. You can learn more about how brokers and lenders get paid when working on agency loans here.

Zero Conflicts of Interest

Obviously, any scenario where you don’t have to pay the fee sounds attractive (and possibly too good to be true). So how does it actually work?

TermSt. developed this program as the only multifamily financing program in the industry that has zero conflicts of interest. Our only interest, like yours, is to ensure that you find the absolute best multifamily financing terms—whether your next loan comes from Fannie Mae, Freddie Mac, a life company, debt fund, bank, credit union, or any other lender. We previously wrote about the conflicts inherent in the agency lending process here.

The Term Street method

Most brokers could never afford to take on assignments that only pay 0.01%. At TermStreet, we’re built differently. Our technology empowers our clients to engage more lenders in less time. The point is to completely revamp the process of finding the best terms on your next loan.

We begin with 3-5 Fannie Mae and Freddie Mac lenders. This ensures that you get well-thought-out and competitive agency quotes. At the same time, we engage top life insurance, bank, and debt fund lenders using your best agency quotes as the

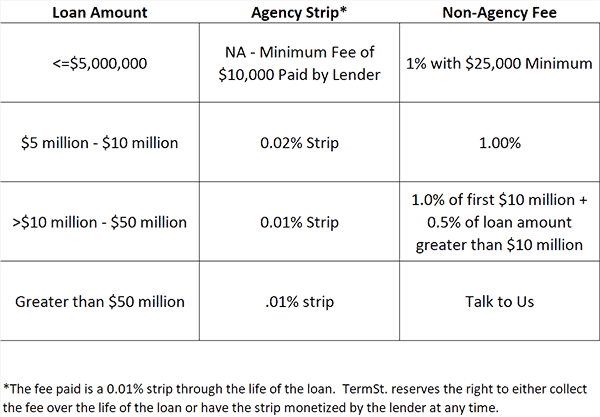

If we can beat your agency quotes, you pay us our full fee (see table below). If we can’t, you close your Fannie Mae or Freddie Mac loan, and your lender pays us a servicing strip of 0.01%.

Simplicity wins

The Term Street program is simple. It’s low cost. It’s efficient. It’s free of conflicts of interest. There is simply no better platform for multifamily lender engagement. But you don’t have to take our word for it. Instead, go ahead and schedule a demo so you can take a look for yourself.

TermStreet Fee Schedule